The Industry Challenge

Financial institutions are facing mass disruption. Digital transformation is the biggest innovation, or cluster of innovations, facing financial institutions in years. Every part of the business is facing increased competition due to new market entrants, increasing mobile/digital adoption and shifting customer expectations. As financial institutions adopt agile product processes with aggressive launch cycles, Horizn is helping educate employees and customers on the latest innovations in real-time, building digital fluency and accelerating digital adoption.

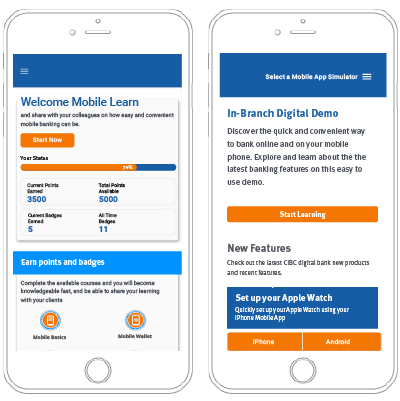

The Opportunity with Horizn

For us at Horizn, we know that “build it and they will come” is a myth. It is not a strategy or method of adoption. This is where we come in… as our clients are transforming their businesses, we ensure that employees and customers are educated on their latest digital innovations so that the right knowledge, at the right time, is delivered directly to all key stakeholders. The Horizn platform improves digital fluency and increases digital adoption with employees, frontline staff, customer service, and directly with customers.